The fixed-rate cliff is here

FCA data shows that around 850,000 five-year fixed-rate mortgages were taken out in 2021 at an average rate of 2.3%. As these deals end in 2026, many borrowers will face a sharp rise in repayments — either by reverting to their lender’s variable rate or switching to a new, higher fixed rate. For hundreds of thousands of households, this will add further pressure to already stretched living costs.

How PT+ helps

PT+ is our enhanced product transfer service that, where suitable, combines a standard product transfer with a second charge mortgage to improve client affordability. When you refer a client nearing the end of their fixed rate, we review their credit file and, if appropriate, arrange a second charge to consolidate debts and free up disposable income.

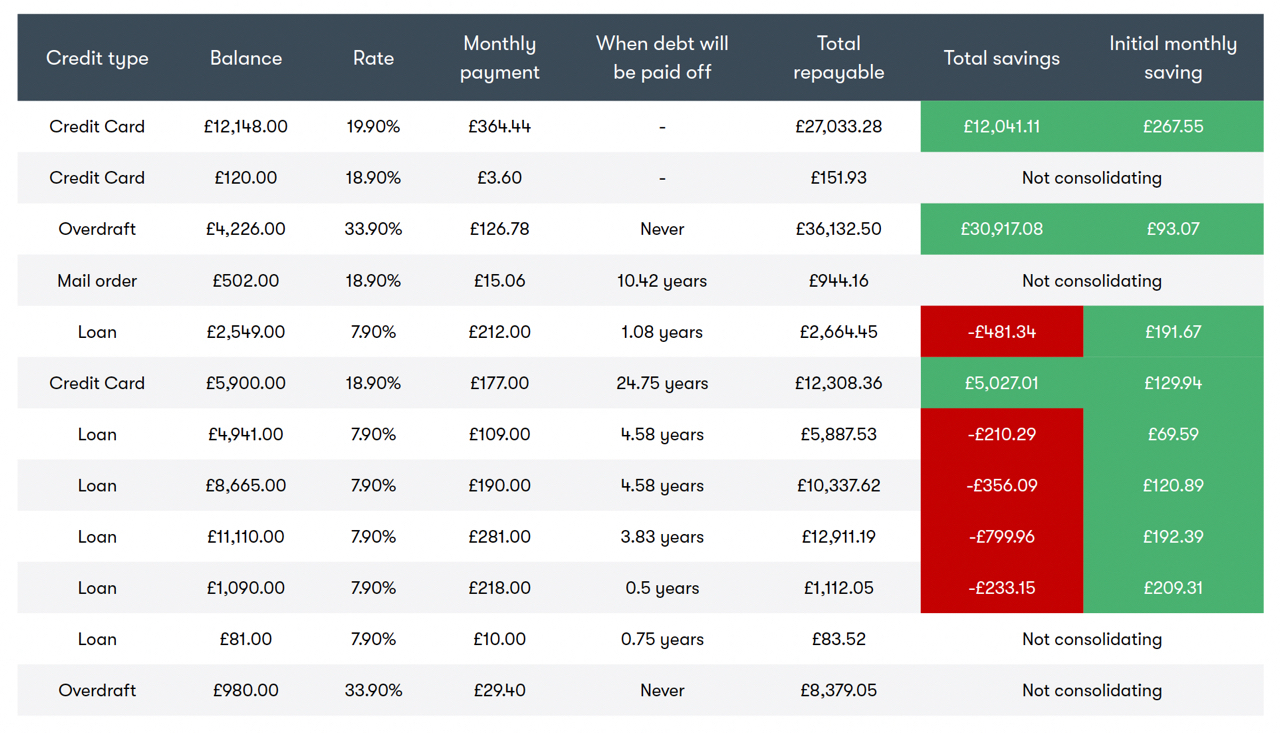

They’ll receive a personalised product suitability report, breaking down each debt, detailing the monthly and total costs or savings over the term of the loan.

By protecting clients from payment shock, PT+ not only safeguards their financial wellbeing but also generates multiple income streams for you — with Y3S managing the process end-to-end and taking full regulatory responsibility.

* Savings based on H1, 2025 Y3S completions. Actual savings will vary depending on each client circumstances.

Platinum Feefo Rating

You can trust us to look after your clients and keep you updated every step of the way – and you don’t have to just take our word for it. Our Platinum Feefo rating – for four consecutive years – shows just how far our exceptional service goes and know-how reaches.

Sign up for the latest news and updates

Any personal data you provide is subject to Specialist Mortgage Group’s privacy policy